I currently have space for 6 Pins and 9 Arcade Machines setup across my two garages. I currently own 8 Pins and am looking at space in my garden to hopefully build another Pinball room next year

Pinball info

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Curious, Collection size

- Thread starter Pop Bumper Pete

- Start date

Own 4 and 1 currently on loan from a friend, room for 2 at mine and 2 at my girlfriends. Unfortunately only have 2 set up at my girlfriends at the moment as we're trying to sell my place and move (worlds worst timing I know so probably going to hold off until next year) so space for pins in the new house / space for a pin shed are a huge factor when looking at properties.

That is why i asked the questionSome of us here have plenty of space, I can fit at least 70 in my garage and 15 in an outbuilding then as many probably in various places around the house.

I know from reading the forums that some people have a warehouse for their games, but I have no idea of what size a family house in the UK even looks like

It would be foolish for me to judge everyone against Harry Potter or Doctor Who

That is why i asked the question

I know from reading the forums that some people have a warehouse for their games, but I have no idea of what size a family house in the UK even looks like

It would be foolish for me to judge everyone against Harry Potter or Doctor Who

Privet Drive is fairly typical of housing estates from the last 30 years in the UK tbf

House size varies massively in the UK. The photo above would be relatively typical of a new build estate. Probably comes with a small back garden.

There’s still lots of Victorian housing stock in use.

Lots of terrace housing in cities and “back to back” buildings in places such as the midlands.

What you get for your money varies massively. A flat in London can literally be the same price as a castle in the **** end of Scotland. (Although I’d dread to think how high the heating bills would be).

The only common denominator is that it tends to be very expensive compared to the average wage in that area. 9-10 times salary is pretty common. 20x plus for some places . This is a problem that s getting worse. (This s VERY regional though.)

. This is a problem that s getting worse. (This s VERY regional though.)

Most cities tend to be relatively centralised. London is not typical of other cities such as Leeds etc. Friends there can go out for an evening and bump into others in the city centre. In London even if you plan to be in the same borough you probably won’t meet up.

Harry Potter and rom-coms are not typical of the average house. We also have lots of areas where there are huge houses right next door to council estates. Lots of these sprung up after WWII when old houses were destroyed and lots of new flats built on the plot.

In this area lack of space dictates the size of a collection more than the cost of machines. In other areas the reverse would be true.

There’s still lots of Victorian housing stock in use.

Lots of terrace housing in cities and “back to back” buildings in places such as the midlands.

What you get for your money varies massively. A flat in London can literally be the same price as a castle in the **** end of Scotland. (Although I’d dread to think how high the heating bills would be).

The only common denominator is that it tends to be very expensive compared to the average wage in that area. 9-10 times salary is pretty common. 20x plus for some places

Most cities tend to be relatively centralised. London is not typical of other cities such as Leeds etc. Friends there can go out for an evening and bump into others in the city centre. In London even if you plan to be in the same borough you probably won’t meet up.

Harry Potter and rom-coms are not typical of the average house. We also have lots of areas where there are huge houses right next door to council estates. Lots of these sprung up after WWII when old houses were destroyed and lots of new flats built on the plot.

In this area lack of space dictates the size of a collection more than the cost of machines. In other areas the reverse would be true.

Yeah it depends where you are same as everywhere, avg. houses smaller in towns/cities normally.That is why i asked the question

I know from reading the forums that some people have a warehouse for their games, but I have no idea of what size a family house in the UK even looks like

It would be foolish for me to judge everyone against Harry Potter or Doctor Who

I moved out of London to have more space, came here in two 7.5 ton trucks with quite a few machines.

Saying that some big expensive houses in towns/city’s and let’s face it if you are going to have a big collection of pinballs you are going to be pretty well off these days. My brothers house in London was massive that he has just sold, think it was about 7000 square feet with about 2 acres - £2.5m!

Too many variables, my house was a Victorian school for example so plenty of space and never go upstairs these days.

I had owned a 2 bedroom flat and a 3 bedroom Victorian end terrace house in London previously so not much room there.

I just did a search and the avg. size house here is saying 820 ft2, Australia is saying 2690 ft2 (250m2). Just a bit different!

That seems small to me for UK?

My problem is outside space, where I live it’s really difficult to get planning for outbuildings. I also prefer playing the machines out of the house for some reason I suspect it’s a nostalgia thing from when I worked for an operator in the early 80’s repairing and playing the machines in the workshop, I miss those days .

Drew

Drew

Bloody hell. Where in London comes with 2 acres? 2.5m sounds a bargain for somewhere that big

I love city living but my place is 5 meters wide and we’ve got 18 people living either side of us sharing communal walls. . Moving though would cost way over £100k in stamp duty alone so isn’t going to happen.

. Moving though would cost way over £100k in stamp duty alone so isn’t going to happen.

Pretty certain we’re the noisy neighbours though.

I love city living but my place is 5 meters wide and we’ve got 18 people living either side of us sharing communal walls.

Pretty certain we’re the noisy neighbours though.

Should have been £3mil but divorce situation, gated estate in Denham where the rich and famous live. They call it London like they do in CroydonBloody hell. Where in London comes with 2 acres? 2.5m sounds a bargain for somewhere that big

I love city living but my place is 5 meters wide and we’ve got 18 people living either side of us sharing communal walls.. Moving though would cost way over £100k in stamp duty alone so isn’t going to happen.

Pretty certain we’re the noisy neighbours though.

Size of house doesn't always reflect pin stash when the addiction bites

Unfortunately when you try to release them in the wild commercial property in UK is very expensive

Unfortunately when you try to release them in the wild commercial property in UK is very expensive

Had to google Denham. Looks lovely but 100% isn’t London. It’s Bucks.

I know I’m from Acton, it’s like that around there. Uxbridge, Southall etc is the same even BrentfordHad to google Denham. Looks lovely but 100% isn’t London. It’s Bucks.

Those that can afford £1.6m houses should also be able to afford and should be the ones paying £100K in stamp duty.Moving though would cost way over £100k in stamp duty alone so isn’t going to happen.

And if the stamp duty were removed house prices would just go up by an equivalent amount. This happened in lockdown when sdlt holiday was implemented - buyers just paid more in order to benefit from the sdlt holiday.

Interesting idea. Pretty sure everyone’s idea of a fair tax is one that affects other people

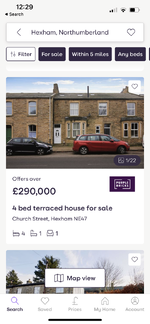

I’ve got no idea what you get for say a million in Hexham but trust me in London that’s a standard sized house (at best. Often a flat). So that £100k tax is coming out of the salaries of nurses, taxi drivers etc. Hardly the multimillionaires people imagine.

I get approx £6k as an inner London weighting for my job. So in theory my housing costs should be about £30k more than doing the exact same job in a different part of the country (in reality it’s actually paid less than the same job in Wales or Scotland).

Not everyone in the city is on big cash but we all have to pay huge amounts to buy or rent. This combined with an inability to WFH and high transport costs are making it really hard to get anyone young into customer facing roles.

It’s a similar situation with proposed “mansion taxes”. An arbitrary amount means a mid range terrace in some areas but not a sprawling 8 bed huge place in other areas.

Much as I love living in London the housing situation is screwed especially for young buyers. Living in the capital is wonderful but it drains money like a vampire goes for blood.

I’ve got no idea what you get for say a million in Hexham but trust me in London that’s a standard sized house (at best. Often a flat). So that £100k tax is coming out of the salaries of nurses, taxi drivers etc. Hardly the multimillionaires people imagine.

I get approx £6k as an inner London weighting for my job. So in theory my housing costs should be about £30k more than doing the exact same job in a different part of the country (in reality it’s actually paid less than the same job in Wales or Scotland).

Not everyone in the city is on big cash but we all have to pay huge amounts to buy or rent. This combined with an inability to WFH and high transport costs are making it really hard to get anyone young into customer facing roles.

It’s a similar situation with proposed “mansion taxes”. An arbitrary amount means a mid range terrace in some areas but not a sprawling 8 bed huge place in other areas.

Much as I love living in London the housing situation is screwed especially for young buyers. Living in the capital is wonderful but it drains money like a vampire goes for blood.

I think there is a fundamental disconnect with house prices as you look around the country. Whatever area you live in sets the norm.

My old classroom was recently turned into a one bed flat. Lovely room within an old Victorian school. It sold for over £1.8 million think what that would buy you in most places in the uk.

think what that would buy you in most places in the uk.

I think the average price of a house in the uk is now meant to be around 220k. We haven’t seen those prices since the early 90s.

It pales into insignificance though compared to rent.

My old classroom was recently turned into a one bed flat. Lovely room within an old Victorian school. It sold for over £1.8 million

I think the average price of a house in the uk is now meant to be around 220k. We haven’t seen those prices since the early 90s.

It pales into insignificance though compared to rent.

The young average person is screwed in London, so glad I moved out nearly 25 years ago as my kids would have struggled and probably would be still living with us.

Now they are thriving thank god.

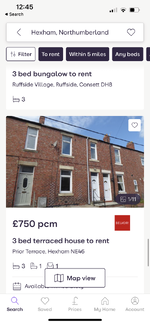

My daughter was a teacher, rent here £750-£950 for a 3 bed or £240k ish. How does that compare in London for your £6k extra, crazy.

Now they are thriving thank god.

My daughter was a teacher, rent here £750-£950 for a 3 bed or £240k ish. How does that compare in London for your £6k extra, crazy.

London is its own little world though.

Two examples that spring to mind

1). Every pinhead from the North who comes to buy a game goes through the same conversation “I’ve checked google maps. It says 90 mins from the end of the M1. I reckon I can do it in 20 mins tops”. Never fails to amuse me . Those 10 miles are actually quicker to walk.

. Those 10 miles are actually quicker to walk.

2). I had a young trainee teacher starting in September. Was giving it large about how fantastic and busy Manchester was. Unfortunately his first day coincided with a tube strike. Poor ****er looked like he’d done a tour of Vietnam by the time he got to work. I got him to teach the same starter lesson three times to different classes. Somehow rather than finding it easier each time he was still up to 4am tweaking his lesson each night. One day 3 he had a total nervous breakdown. Burst into floods of tears and ran off back home vowing to never visit London again.

It’s 100% not the location for everyone.

Two examples that spring to mind

1). Every pinhead from the North who comes to buy a game goes through the same conversation “I’ve checked google maps. It says 90 mins from the end of the M1. I reckon I can do it in 20 mins tops”. Never fails to amuse me

2). I had a young trainee teacher starting in September. Was giving it large about how fantastic and busy Manchester was. Unfortunately his first day coincided with a tube strike. Poor ****er looked like he’d done a tour of Vietnam by the time he got to work. I got him to teach the same starter lesson three times to different classes. Somehow rather than finding it easier each time he was still up to 4am tweaking his lesson each night. One day 3 he had a total nervous breakdown. Burst into floods of tears and ran off back home vowing to never visit London again.

It’s 100% not the location for everyone.

My daughter had hassle from some kids who tried to get her sacked etc and nasty bosses, she was very committed to her job and helped some kids win awards and took them herself to stay in Cardiff to receive them.London is its own little world though.

Two examples that spring to mind

1). Every pinhead from the North who comes to buy a game goes through the same conversation “I’ve checked google maps. It says 90 mins from the end of the M1. I reckon I can do it in 20 mins tops”. Never fails to amuse me. Those 10 miles are actually quicker to walk.

2). I had a young trainee teacher starting in September. Was giving it large about how fantastic and busy Manchester was. Unfortunately his first day coincided with a tube strike. Poor ****er looked like he’d done a tour of Vietnam by the time he got to work. I got him to teach the same starter lesson three times to different classes. Somehow rather than finding it easier each time he was still up to 4am tweaking his lesson each night. One day 3 he had a total nervous breakdown. Burst into floods of tears and ran off back home vowing to never visit London again.

It’s 100% not the location for everyone.

She loved teaching and is a tuff cookie but had enough and is now a recruitment manager for the NHS on much more but said she would go back to teaching if the price was right. She helped a lot of kids from disadvantaged backgrounds, such a shame.

Can be a very stressful job as you know especially where you are.

God the traffic

Well after rush hour and the city is pretty empty as it’s the summer.God the traffic

Thought I’d check how long it would take to get to Brixton. 3 miles. Just over 30 mins drive

Our 20mph speed limits are looking bloody optimistic

Last edited:

Equally everybody's idea of an unfair tax is one that affects them personally.Interesting idea. Pretty sure everyone’s idea of a fair tax is one that affects other people

I’ve got no idea what you get for say a million in Hexham but trust me in London that’s a standard sized house (at best. Often a flat). So that £100k tax is coming out of the salaries of nurses, taxi drivers etc. Hardly the multimillionaires people imagine.

I get approx £6k as an inner London weighting for my job. So in theory my housing costs should be about £30k more than doing the exact same job in a different part of the country (in reality it’s actually paid less than the same job in Wales or Scotland).

Not everyone in the city is on big cash but we all have to pay huge amounts to buy or rent. This combined with an inability to WFH and high transport costs are making it really hard to get anyone young into customer facing roles.

It’s a similar situation with proposed “mansion taxes”. An arbitrary amount means a mid range terrace in some areas but not a sprawling 8 bed huge place in other areas.

Much as I love living in London the housing situation is screwed especially for young buyers. Living in the capital is wonderful but it drains money like a vampire goes for blood.

SDLT impacts me personally more than 99.9% of the population, but despite that I really believe it is one of the fairest taxes.

It targets those most able to pay and puts downward pressure on the housing market in geographical areas where it is most needed. Its a very progressive tax, so more heavily taxes overconsumption. And allowances are made to reduce the burden for first time buyers. and for most who are buying a main residential home it is the only tax they will pay on. And anybody buying a second home or an investment property pays 3% extra on the whole price; so FTBs and main home dwellers are relatively advantaged.

I just see SDLT as an up front tax on the capital gains that will be made over the years of future ownership. At 3% house price inflation a £1m house will be worth £1.8m in 20 years; a gain of £800K. The £42K of SDLT that would be paid is just 5% of this. I just see this as a £1.042m house that appreciates at 2.8% house price inflation.

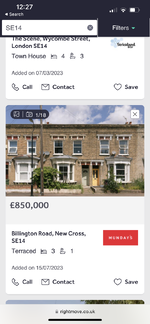

I doubt many nurses and taxi drivers are buying £1.6m homes and paying £100K SDLT. In New Cross £1.6m is the ceiling price and will get you a 6 or 7 bedroom 3,000 square foot (mansion

Hexham is much cheaper than London but not as cheap as many Southern dwellers would expect. Cheap houses are available in the North but you wouldn't want to live in them or in the places they are located. And people still struggle in the North average owner occupied house pries are still 8 or 9x average wage in many areas. Although house prices are lower, average wages around here are £30K whereas it's £50K in London. And the essentials (transport, energy, food etc.) cost the same from a much lower wage, so there is proportionately much less to spend on housing.

London is expensive for housing as demand always outstrip supply; always has been this way; always will be. As a youngster, I financially crippled myself in the 1990s buying a flat in London Docklands. Youngsters were screwed back then as they are now. It's the downside of living in London. Each of us has to make the lifestyle decision as to whether the plentiful upside of living in the capital city outweighs that downside. You pays your money you takes your choice.

Always hard to compare areas (and remember New Cross is hardly held up as an example of a posh or expensive part of London which is why we bought here)

Anyway, here’s two roughly similar houses. Both I’d argue would be suitable for young families. (The cheaper one actually has one more bedroom). No bells and whistles on either one but you could bring up a family in them.

One attracts a stamp duty of £2000 and the other £30000. Not really convinced that’s a fair difference

There are loads of properties now near us with one aging owner who is never going to downsize. Stamp duty plays a part in this.

Anyway, here’s two roughly similar houses. Both I’d argue would be suitable for young families. (The cheaper one actually has one more bedroom). No bells and whistles on either one but you could bring up a family in them.

One attracts a stamp duty of £2000 and the other £30000. Not really convinced that’s a fair difference

There are loads of properties now near us with one aging owner who is never going to downsize. Stamp duty plays a part in this.

Attachments

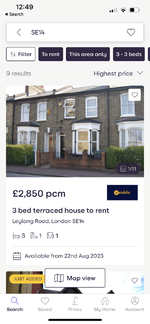

As I mentioned earlier renting is where people really get ****ed over. Bit harder to compare. But these are similar-ish.

London’s always been expensive to buy but my first flat was about 8 times my salary in 1997. It’s now 15 times my current salary (plus the increase in stamp duty as soon as it went past 250k and then 500k). [Bit depressing as I’m now more than 20 years into my career with X numbers of promotions and responsibilities]

Young people are utterly stuffed.

BTW I’m not actually against tax. I’d just rather see it on income tax and a crack down on avoidance schemes.

London’s always been expensive to buy but my first flat was about 8 times my salary in 1997. It’s now 15 times my current salary (plus the increase in stamp duty as soon as it went past 250k and then 500k). [Bit depressing as I’m now more than 20 years into my career with X numbers of promotions and responsibilities]

Young people are utterly stuffed.

BTW I’m not actually against tax. I’d just rather see it on income tax and a crack down on avoidance schemes.

Attachments

I love the comparisons, John. It really does show what a world away London is from up here. But both do have similar housing problems just at different financial levels If HMRC slapped £30K of SDLT on the £290K property it would just sell for £260K instead so the buyer could afford to pay the SDLT. It's in a village with a couple of pubs, butcher, doctors, local co-op. Nearest Tesco/Macs/Restaurants/Petrol station is about 8 miles away in Hexham. Funnily enough Hexham only got its Macs about 2 years ago - prior to that closest one was (thankfully) another 20 miles away near Newcastle. It's a different world to London. The £290K house will likely sell to somebody local who will struggle to afford it. I'm not sure many would want to rent in Consett (sorry, Consett) and its pretty tough to get a well paying job there (any job is hard to come by).

Underutilised properties with single ageing owners are increasing. My experience is that they often don't have the physical or mental capacity to uproot, want to stay close to their community, don't need the money downsizing potentially brings, want to stay put for emotional reasons (it was the family house) or an appropriate property to move to is just not available locally. Potential SDLT cost in downsizing may be low on the list or even unknown to them - its just another press story to make an issue of SDLT.

Similar can be said for underutilised social housing; people don't want to move out once they are in; often for the same reasons as owner occupiers. But we all saw how the bedroom tax went so no politician will risk meddling with that again.

Underutilised properties with single ageing owners are increasing. My experience is that they often don't have the physical or mental capacity to uproot, want to stay close to their community, don't need the money downsizing potentially brings, want to stay put for emotional reasons (it was the family house) or an appropriate property to move to is just not available locally. Potential SDLT cost in downsizing may be low on the list or even unknown to them - its just another press story to make an issue of SDLT.

Similar can be said for underutilised social housing; people don't want to move out once they are in; often for the same reasons as owner occupiers. But we all saw how the bedroom tax went so no politician will risk meddling with that again.

I was thinking about this more last night.

When I bought my flat in 97 stamp duty was about two weeks take home pay. More of a pain than a major burden to purchasing a place.

Roll forward 26 years and my pay has roughly doubled. Stamp duty on the flat though would now be virtually an entire year’s take home pay at my new rates .

.

Something is far from right with that situation. Things should become more affordable as you progress in a career not far more unobtainable. (there’s an argument that I choose my career poorly…..)

(there’s an argument that I choose my career poorly…..)

In truth it’s a bit of a moot point for me as I’m not buying or selling but I’m now of that age when my kids will be leaving home soon and they are pretty much buggered. In reality I’m going to have to help them out financially and that’s a real can of worms. Do I sell all my pins to give them a deposit? But if I give them cash and they split with their partners have I just given someone else’s kid a small fortune? If one lives here and one in the midlands should I give them the same amount?

I keep thinking there will be a house price correction sooner or later as who can afford the prices but suspect we are more likely to see static prices than a 50% devaluation.

If you really want to wind me up try mentioning inheritance tax. Something that going forward is going to absolutely hammer the vast majority of people buying property at current prices down here as opposed to virtually no one in the past. Potentially fair enough if you’ve made large capital gains but if you’re a young buyer in a static market that’s one hell of a tax burden to leave your kids.

When I bought my flat in 97 stamp duty was about two weeks take home pay. More of a pain than a major burden to purchasing a place.

Roll forward 26 years and my pay has roughly doubled. Stamp duty on the flat though would now be virtually an entire year’s take home pay at my new rates

Something is far from right with that situation. Things should become more affordable as you progress in a career not far more unobtainable.

In truth it’s a bit of a moot point for me as I’m not buying or selling but I’m now of that age when my kids will be leaving home soon and they are pretty much buggered. In reality I’m going to have to help them out financially and that’s a real can of worms. Do I sell all my pins to give them a deposit? But if I give them cash and they split with their partners have I just given someone else’s kid a small fortune? If one lives here and one in the midlands should I give them the same amount?

I keep thinking there will be a house price correction sooner or later as who can afford the prices but suspect we are more likely to see static prices than a 50% devaluation.

If you really want to wind me up try mentioning inheritance tax. Something that going forward is going to absolutely hammer the vast majority of people buying property at current prices down here as opposed to virtually no one in the past. Potentially fair enough if you’ve made large capital gains but if you’re a young buyer in a static market that’s one hell of a tax burden to leave your kids.

Similar situation for me - both kids graduating Uni next year. One is very positive and already talking of buying his first property. The other is doesn't think he will be able to afford to buy but given he is expecting a first or 2:1 in Maths Computer Science from a Russell Group Uni I expect he will have less trouble than most. But I will help them with deposits - its just giving them their inheritance early and no inheritance tax to pay on it provided me or my spouse lives 7 years after gifting. Plus they get it when they most need it - not when they are already in their 40s or 50s or hopefully 60s and have either made their own way or struggled to get by for 20 or 30 years (possibly with a young family). And I get to see them enjoy / make use of the money.

Property can be held by several owners as "Tenants in common" rather than in the usual way that is customary as "joint tenants" where each owner has full rights to all the property - you can set it up 60% / 40% beneficial ownership or whatever percentage the parties agree to.

Inheritance tax is a tax for the wealthy that don't trust their kids. I will gift to mine early anything that I expect I will not need. If you are married and with property on the death of last of the couple to die effectively the first £1m of the estate is tax free. If you can manage your assets down to be less than a million when the last of you and your spouse dies (by gifting children everything above at least 7 years before) then they won't pay any IHT. More difficult to do if you have a property in London during retirement. And if the kids have the burden of a huge IHT bill they will also have a much larger sum to pay the tax bill with - i.e. the proceeds from your estate.

Just don't worry about it too much. Its a nice problem to have.

And we have probably hijacked this thread enough, John.

Property can be held by several owners as "Tenants in common" rather than in the usual way that is customary as "joint tenants" where each owner has full rights to all the property - you can set it up 60% / 40% beneficial ownership or whatever percentage the parties agree to.

Inheritance tax is a tax for the wealthy that don't trust their kids. I will gift to mine early anything that I expect I will not need. If you are married and with property on the death of last of the couple to die effectively the first £1m of the estate is tax free. If you can manage your assets down to be less than a million when the last of you and your spouse dies (by gifting children everything above at least 7 years before) then they won't pay any IHT. More difficult to do if you have a property in London during retirement. And if the kids have the burden of a huge IHT bill they will also have a much larger sum to pay the tax bill with - i.e. the proceeds from your estate.

Just don't worry about it too much. Its a nice problem to have.

And we have probably hijacked this thread enough, John.

Agree on your view on stamp duty in principle but see it as consumption tax - inflation is going to eat most of your property appreciation sadly.Equally everybody's idea of an unfair tax is one that affects them personally.

SDLT impacts me personally more than 99.9% of the population, but despite that I really believe it is one of the fairest taxes.

It targets those most able to pay and puts downward pressure on the housing market in geographical areas where it is most needed. Its a very progressive tax, so more heavily taxes overconsumption. And allowances are made to reduce the burden for first time buyers. and for most who are buying a main residential home it is the only tax they will pay on. And anybody buying a second home or an investment property pays 3% extra on the whole price; so FTBs and main home dwellers are relatively advantaged.

I just see SDLT as an up front tax on the capital gains that will be made over the years of future ownership. At 3% house price inflation a £1m house will be worth £1.8m in 20 years; a gain of £800K. The £42K of SDLT that would be paid is just 5% of this. I just see this as a £1.042m house that appreciates at 2.8% house price inflation.

I doubt many nurses and taxi drivers are buying £1.6m homes and paying £100K SDLT. In New Cross £1.6m is the ceiling price and will get you a 6 or 7 bedroom 3,000 square foot (mansion) house. The nurses and taxi drivers aren't paying £100K SDLT because they are buying the 3 bedroom Victorian terraces for £750K and paying £25K SDLT. Still a lot of money, but its only 3% of the property value.

Hexham is much cheaper than London but not as cheap as many Southern dwellers would expect. Cheap houses are available in the North but you wouldn't want to live in them or in the places they are located. And people still struggle in the North average owner occupied house pries are still 8 or 9x average wage in many areas. Although house prices are lower, average wages around here are £30K whereas it's £50K in London. And the essentials (transport, energy, food etc.) cost the same from a much lower wage, so there is proportionately much less to spend on housing.

London is expensive for housing as demand always outstrip supply; always has been this way; always will be. As a youngster, I financially crippled myself in the 1990s buying a flat in London Docklands. Youngsters were screwed back then as they are now. It's the downside of living in London. Each of us has to make the lifestyle decision as to whether the plentiful upside of living in the capital city outweighs that downside. You pays your money you takes your choice.

And I would have room for 10 but only have two. Had 18 when I still had a basement in Germany but those are all sold. Regret that to a degree, will never see a MM for 350 € again...

Interesting idea. Pretty sure everyone’s idea of a fair tax is one that affects other people

I’ve got no idea what you get for say a million in Hexham but trust me in London that’s a standard sized house (at best. Often a flat). So that £100k tax is coming out of the salaries of nurses, taxi drivers etc. Hardly the multimillionaires people imagine.

I get approx £6k as an inner London weighting for my job. So in theory my housing costs should be about £30k more than doing the exact same job in a different part of the country (in reality it’s actually paid less than the same job in Wales or Scotland).

Not everyone in the city is on big cash but we all have to pay huge amounts to buy or rent. This combined with an inability to WFH and high transport costs are making it really hard to get anyone young into customer facing roles.

It’s a similar situation with proposed “mansion taxes”. An arbitrary amount means a mid range terrace in some areas but not a sprawling 8 bed huge place in other areas.

Much as I love living in London the housing situation is screwed especially for young buyers. Living in the capital is wonderful but it drains money like a vampire goes for blood.

Here's what a million quid gets you in my town! Round the corner from me. Just need to lottery numbers to come in

Check out this 6 bedroom house for sale on Rightmove

6 bedroom house for sale in Waldridge, Chester Le Street, DH2 for £1,100,000. Marketed by Fine and Country, Durham