In an effort to curb Side Hustles this year the HMRC are now supplied with each sellers total sales over each finantial year.

This is to stop non declared earnings and black market traders.

So what does this mean for people who sell there pins on eBay?

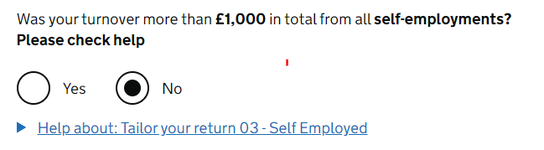

Well apparently you can trade on any Marketplace as long as it’s below £1000 in any financial year in total and HMRC won’t be informed if you sell less than 30 items in that same period.

I myself put quite a bit on eBay for a non techie mate who trades action figures from NECA etc. This is usually well over both limits and I even take the payments and give him cash so that will now come to an end for sure.

It will be interesting to see how many pins now come up for sale albeit not everyone will be aware of the new rules straight away.

This is to stop non declared earnings and black market traders.

So what does this mean for people who sell there pins on eBay?

Well apparently you can trade on any Marketplace as long as it’s below £1000 in any financial year in total and HMRC won’t be informed if you sell less than 30 items in that same period.

I myself put quite a bit on eBay for a non techie mate who trades action figures from NECA etc. This is usually well over both limits and I even take the payments and give him cash so that will now come to an end for sure.

It will be interesting to see how many pins now come up for sale albeit not everyone will be aware of the new rules straight away.